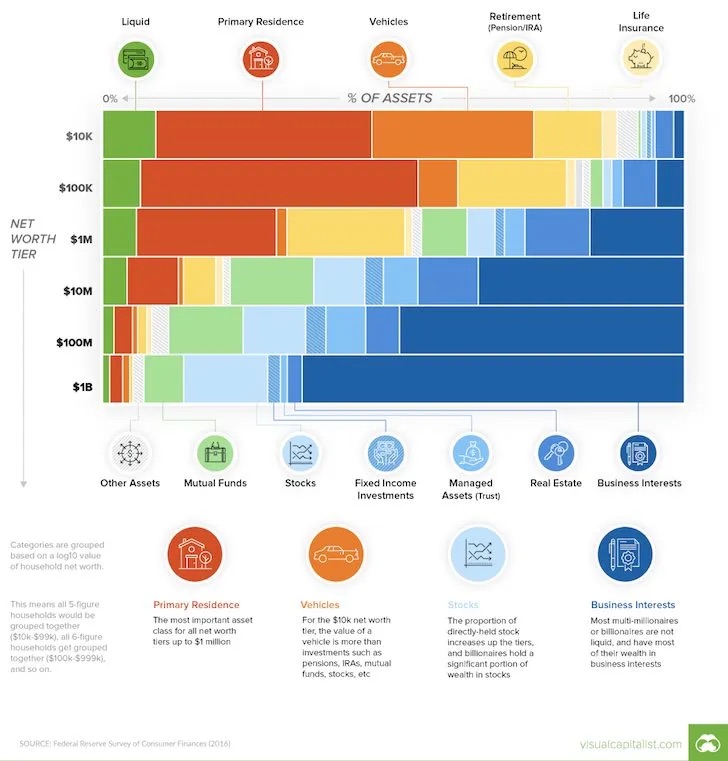

Have you ever wondered how the wealthiest individuals seem to effortlessly grow their fortunes, while the rest of us struggle to keep up? As it turns out, the answer lies in the way they allocate their assets. A recent data visualization has shed light on the stark differences in portfolio composition across wealth tiers, and the findings are eye-opening.

As we move up the wealth ladder, a clear pattern emerges. The proportion of assets tied up in primary residences and vehicles, which are essentially non-productive, steadily decreases. For those in the $10M+ group, these assets account for a mere sliver of their overall wealth. Instead, the ultra-wealthy focus on assets that have the potential for high returns over time, such as business interests and stocks.

Remarkably, for the $10M+ tier, around 50% of their assets are concentrated in business interests alone. While these investments are often highly illiquid, they can provide exceptional returns if the companies succeed. This strategy allows the ultra-rich to supercharge their wealth compounding. Moreover, by keeping a relatively small portion of their wealth in their primary residence, they minimize the disruption to their compounding process when making home purchases.

Another interesting observation is that the $10M+ group holds a significantly smaller proportion of their assets in fixed income investments and managed assets compared to more liquid alternatives. This aligns with the notion that the ultra-wealthy tend to be less risk-averse and are comfortable with concentrated portfolios. By having lower exposure to bonds, their wealth is also less susceptible to being eroded by inflation over time.

Of course, it’s important to note that everyone’s financial situation is unique, and these findings represent general trends. However, this data visualization effectively illustrates how different portfolio compositions, with their associated risk and return profiles, can lead to vastly different wealth trajectories over time.

So, what can we learn from the asset allocation strategies of the ultra-wealthy? First and foremost, it’s crucial to be thoughtful and intentional about your investment strategy in the context of your long-term goals. While not everyone has the means or risk tolerance to mirror the portfolio of a billionaire, we can still take away valuable lessons.

Consider concentrating your assets and focusing on investments that have the potential for growth, such as stocks or real estate. Concentrated investments are highly risky but had the potential for higher returns. Be mindful of how much of your wealth is tied up in non-productive assets, and try to minimize the disruption to your compounding process when making large purchases. Finally, remember that building wealth is a long-term game. By making smart, informed decisions and allowing your investments to compound over time, you can put yourself on the path to financial success.

In conclusion, the data visualization of asset breakdown across wealth tiers provides a fascinating glimpse into the wealth-building strategies of the ultra-rich. By understanding and selectively applying these insights to our own financial lives, we can work towards making our money work harder and smarter, just like the wealthiest among us. We will go deeper into these concepts in the coming days.

Leave a comment